A) is prescribed by GAAP.

B) is uniform for all businesses.

C) usually starts with income statement accounts.

D) usually starts with balance sheet accounts.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company has received a payment from a customer, then

A) its cash account will be debited.

B) its cash account will be credited.

C) the cash account debits will exceed the cash account credits.

D) accounts receivable would be debited

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

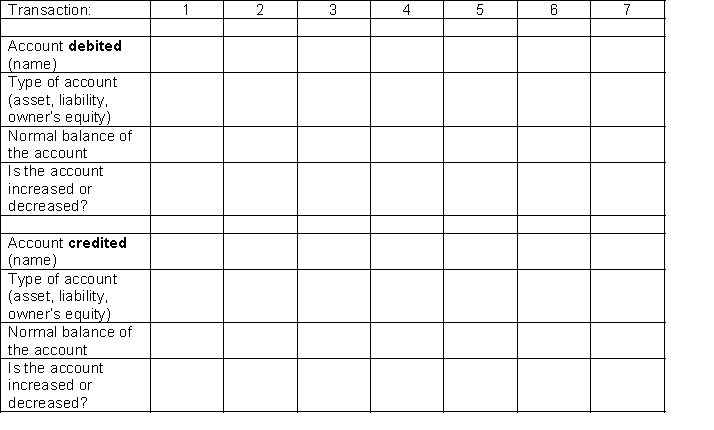

Matt Dudeck has operated a lawn care business for 3 months. The following transactions occurred in the fourth month:

1. Matt decides that the business needs a new vehicle. A truck is purchased for $20,000 and financed by a note payable for the full amount.

2. Matt invested $5,000 of his own funds in the business.

3. Invoices to customers were issued for services completed. The total invoices amount to $4,500.

4. Paid $350 on account for supplies purchased the prior month.

5. Collected $3,750 from customers for work completed and invoiced the prior month.

6. Paid wages of $250 to an assistant.

7. Received $300 deposit from a new customer for whom work will not be performed until next month.

For each transaction, complete the information on the following table:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The procedure of transferring journal entries to the ledger accounts is called

A) journalizing.

B) analyzing.

C) reporting.

D) posting.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To increase a liability account, the account is

A) debited.

B) credited.

C) posted.

D) journalized.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A trial balance is a listing of

A) transactions in a journal.

B) the chart of accounts.

C) general ledger accounts and balances.

D) the totals from the journal pages.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Transactions are recorded in alphabetical order in a journal.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In recording business transactions, evidence that an accounting transaction has taken place is obtained from

A) source documents of the business.

B) the Canada Revenue Agency.

C) the marketing department.

D) the trial balance.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A chart of accounts is

A) is only necessary for manual systems.

B) used only in companies with a complex business structure.

C) the first step in designing an accounting system.

D) a relatively simplistic way of classifying accounts.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Short Answer

Identify the account to be debited and the account to be credited for each of the following transactions: 1. Purchased equipment for cash and a note payable. 2. Accepted a cash deposit from a customer for a service to be provided next month. 3. Provided services on account. 4. Purchased supplies on account 5. Received payment form the client in 3. 6. Provided services to customer in 2 and collected cash for the remaining work done. 7. Owner paid himself. 8. Paid in full for equipment purchased in 1.

Correct Answer

verified

Correct Answer

verified

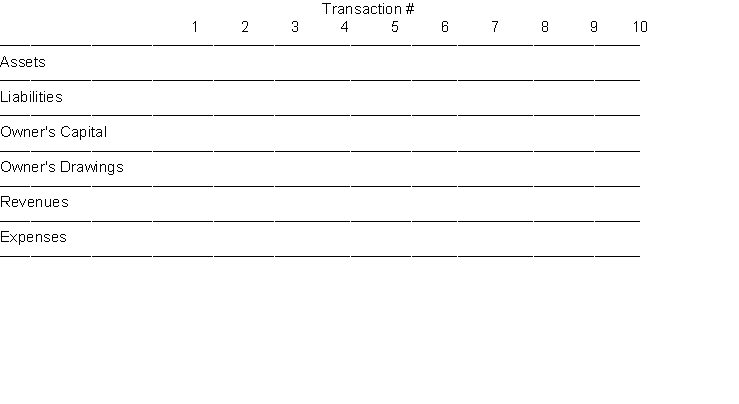

Essay

For each transaction given, enter in the tabulation given below a "D" for debit and a "C" for credit to reflect the increases and decreases of the assets, liabilities, and owner's equity accounts. In some cases there may be a "D" and a "C" in the same column. If there is not a transaction which needs to be recorded, leave the column blank.

Transactions:

1. Owner invests cash in the business.

2. Pays insurance in advance for six months.

3. Hires new administrative assistant.

4. Purchases office supplies on account.

5. Pays electricity bill.

6. Borrows money from local bank.

7. Makes payment on account.

8. Receives cash from customers on account.

9. Provides services to customers on account.

10. Owner withdraws assets from the business.

Correct Answer

verified

Correct Answer

verified

True/False

The drawings account is a subdivision of the owner's capital account and appears as an expense on the income statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The normal balance of any account is the

A) left side.

B) right side.

C) side which increases that account.

D) side which decreases that account.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A list of accounts and their balances at a given time is called

A) a journal.

B) a posting.

C) a trial balance.

D) an income statement.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The normal balance for the cash account is a credit.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On June 1, 2014, Joanne White buys a copier machine for her business and finances this purchase with cash and a note. When journalizing this transaction, she will

A) use two journal entries.

B) make a compound entry.

C) make a simple entry.

D) wait until the end of the month to record the entry.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT true about an asset?

A) Its normal balance is a debit.

B) To increase an asset a debit entry would be made.

C) To increase it, a credit entry should be made.

D) To decrease it, a credit entry should be made.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company pays $5,000 to its creditor. This would

A) increase both the company's assets and liabilities.

B) decrease both the company's assets and liabilities.

C) decrease the company's liquidity.

D) increase the company's owner's equity.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In recording an accounting transaction in a double-entry system

A) the number of debit accounts must equal the number of credit accounts.

B) there must always be entries made on both sides of the accounting equation.

C) the amount of the debits must equal the amount of the credits.

D) there must only be two accounts affected by any transaction.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about errors or irregularities is INCORRECT?

A) Irregularities are unintentional errors.

B) An error is neither ethical nor unethical.

C) An error is the result of an unintentional mistake.

D) Irregularities are the result of an intentional mistake and are generally considered unethical.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 163

Related Exams